CPC is acutely aware of the significant ongoing operational risks of the abnormal climate change issues. Therefore, CPC adopted the “Recommendations of the Task Force on Climate-related Financial Disclosures” (hereinafter referred to as TCFD), established by the Financial Stability Board in its 2022 Sustainability Report. This framework is used by CPC to plan and manage risks and opportunities related to climate change, with annual reviews and adjustments.

Climate Change Scenario Analysis - Challenges and Opportunities with Temperature Increase of 2°C

Scenario analysis is applied to prepare more proactively for the future, anticipating the risks and opportunities presented by climate change. Therefore, assuming the global net zero target by 2050 fails, which could result in a possible global temperature increase of up to 2°C this century, CPC's risk management and response planning will encompass short-term, medium-term, and long-term strategies to address the situation.

Results of Scenario Analysis - Potential Financial Impact from Climate-Related Risks and Opportunities

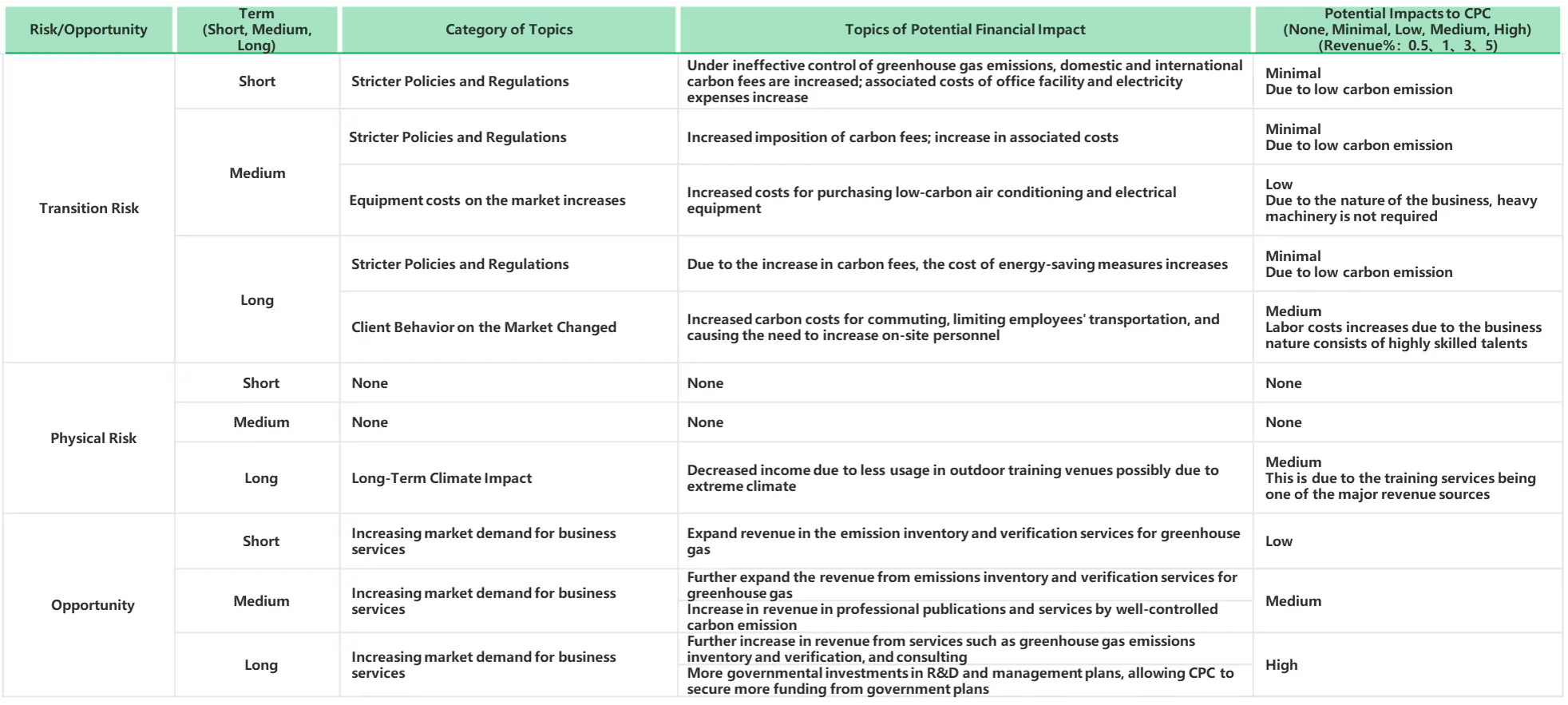

- Referencing the TCFD recommendations on climate-related risks, opportunities, and financial impact dimensions, an analysis of the potential financial impacts on CPC from climate-related risks and opportunities is established

Results of Scenario Analysis - Potential Financial Impact from Climate-Related Risks and Opportunities

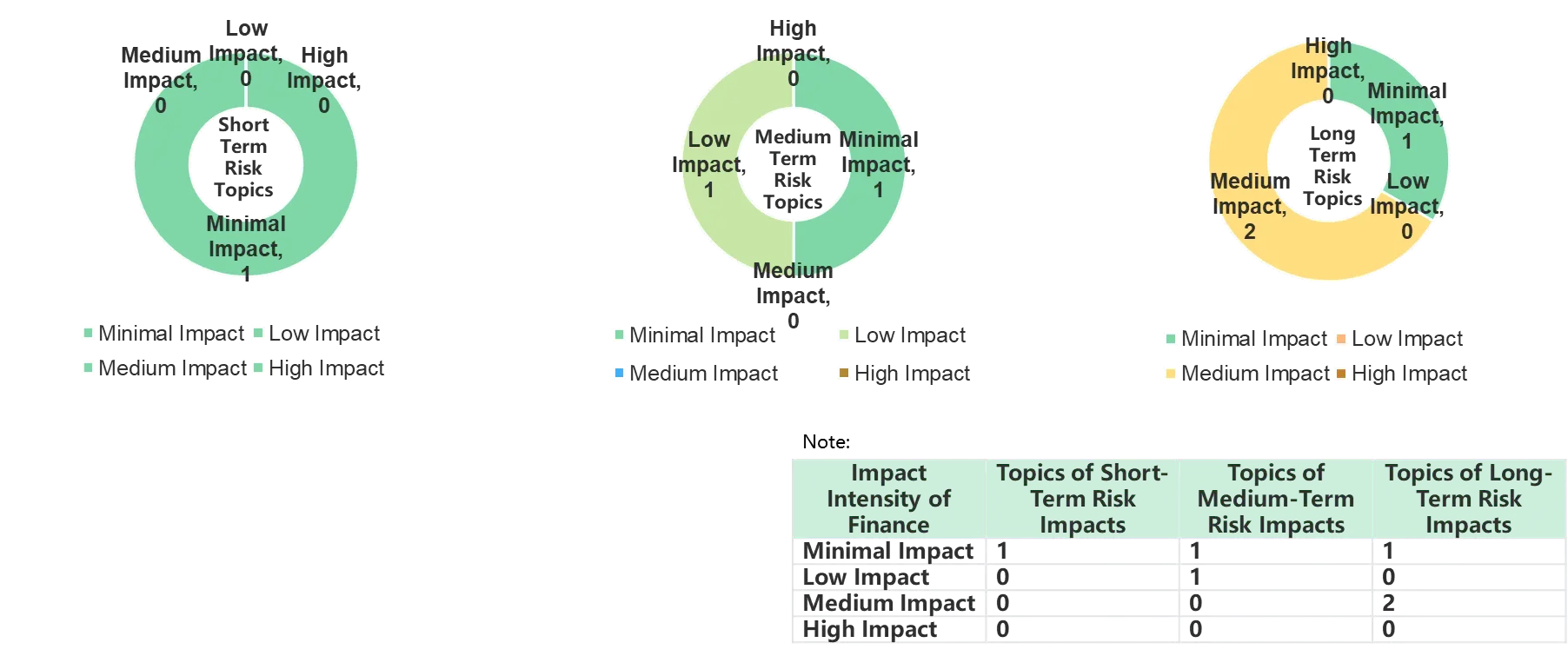

- Short-term, medium-term, and long-term financial risk impact analysis – risk impact as a percentage of revenue: [Minimal 0.5%, Low 1%, Medium 3%, High 5%]

Results of Scenario Analysis - Potential Financial Impact from Climate-Related Risks and Opportunities

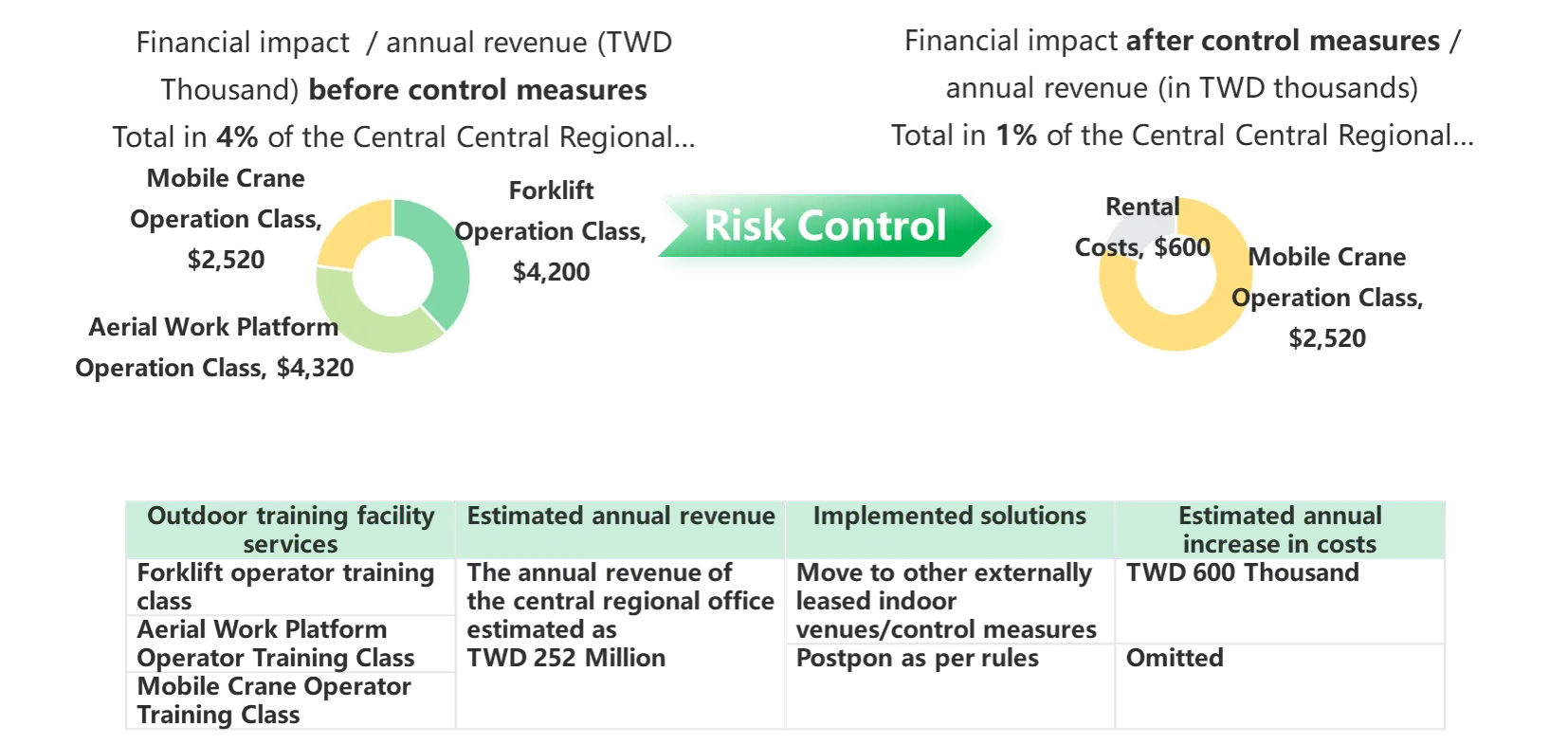

- Control measures for long-term risks (with medium financial impact) – An improvement case study for the Central Regional Training Facility (Note: the Central Regional Office is CPC's largest proprietary outdoor training facility)

Establish TCFD core elements – the climate governance, strategy, risk management, and metrics and targets of CPC